The Big Picture

"Following a brief sales bounce back in August, rapidly rising mortgage rates slowed California home sales in September and resumed the month-to-month declining trend that began in the spring." —California Association of Realtors®

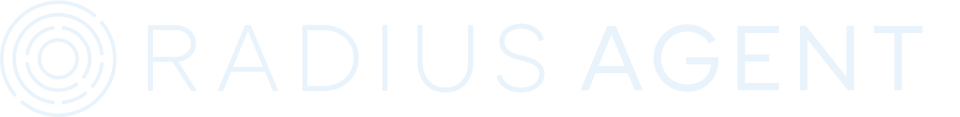

- Home sales in California dropped 31.1% year-over-year in July 2022; last month was the third consecutive month with sales falling more than 10% from a year ago.

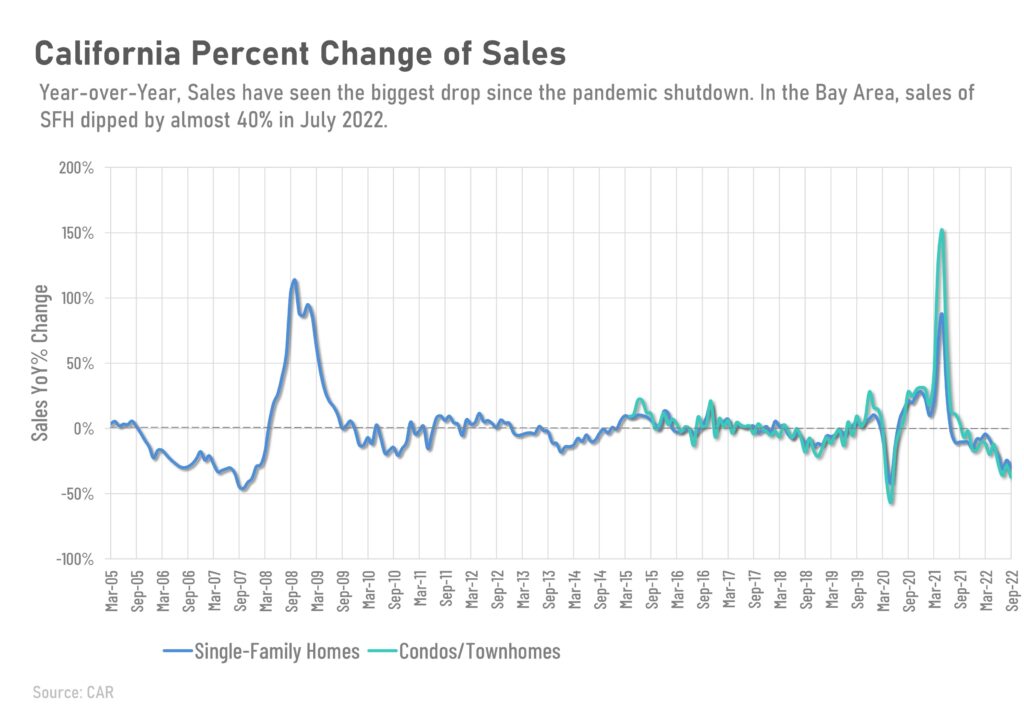

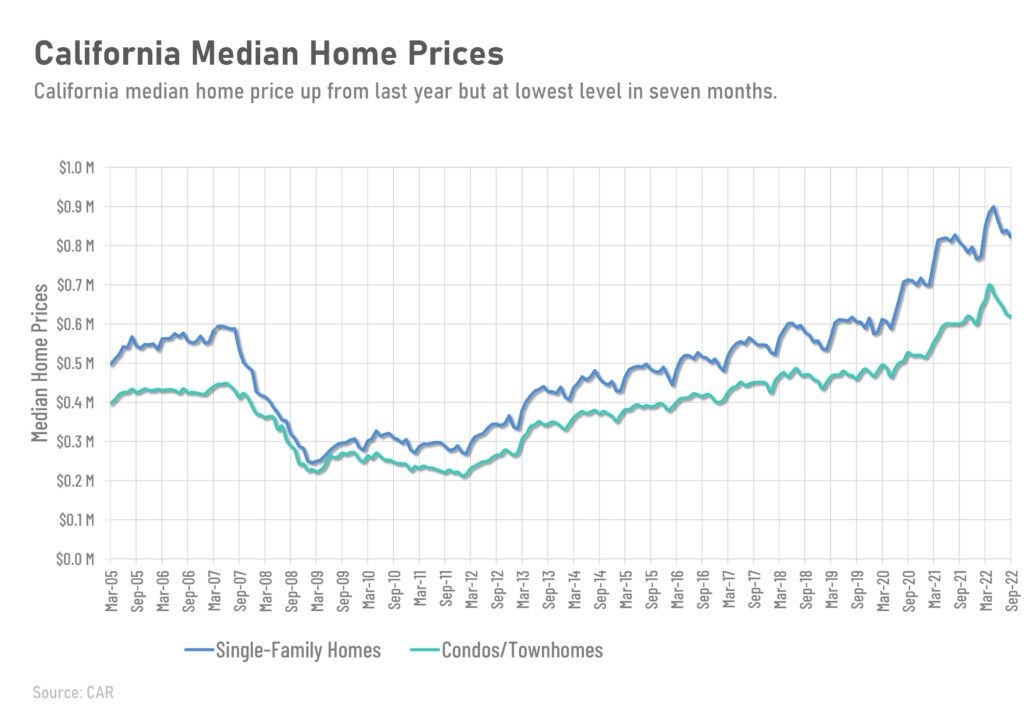

- Prices also began to moderate in the past couple months after the statewide median price set a record high in May 2022.

- Housing supply has been on the rise but will remain below the norm by historical standards preventing housing values from falling too fast.

- As the Federal Reserve continues to raise interest rates in order to bring inflation under control, the downward shift in the housing market will continue to the holiday season and into next year.

Since the 2008 housing bubble burst, the word recession strikes a stronger emotional chord than it ever did before. And while there’s some debate around whether we’re officially in a recession right now, the good news is experts say a recession today would likely be mild and the economy would rebound quickly.

To add to that sentiment, housing is typically one of the first sectors to rebound during a slowdown. Part of that rebound is tied to what has historically happened to mortgage rates during recessions. Historical data helps paint the picture of how a recession could impact the cost of financing a home. Looking at recessions in this country going all the way back to 1980, each time the economy slowed down mortgage rates decreased.

Fortune explains that mortgage rates typically fall during an economic slowdown:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

You might also be wondering if home prices fall every time there’s a recession. Again it helps to turn to historical data. In four of the last six recessions going all the way back to 1980, home prices appreciated. So, historically, when the economy slows down, it doesn’t mean home values will fall.

While history doesn’t always repeat itself, we can learn from it and find some reassurance in the trends of what’s happened in the past.

The Big Picture Data

Silicon Valley Housing Market

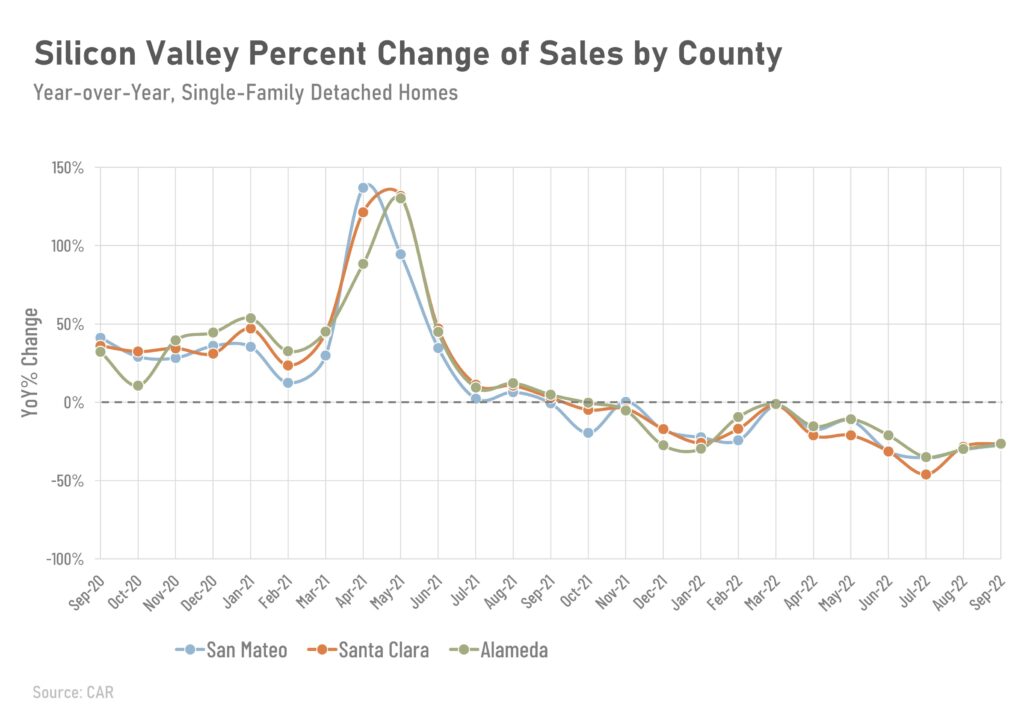

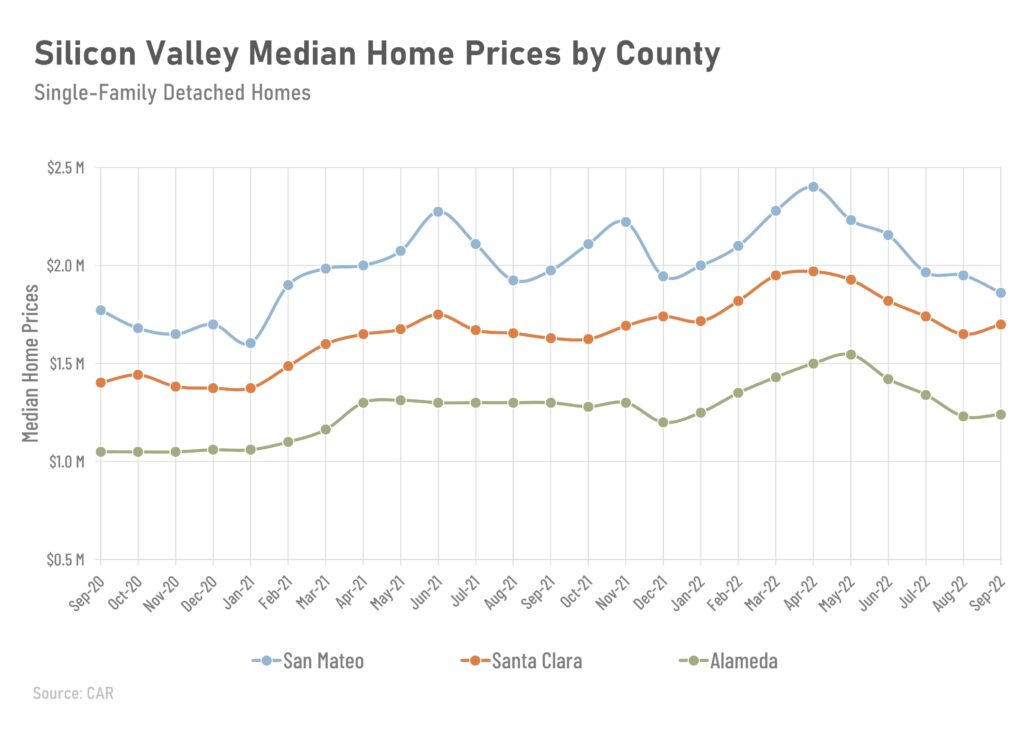

- Sales continued to decline sharply in the third quarter, with the Bay Area recording its largest decline (-37.2%) since the pandemic shutdown in July 2022.

- The Bay Area median home price was $1,256,500, down 18% from its peak in April of this year and down 2.6% from September 2021.

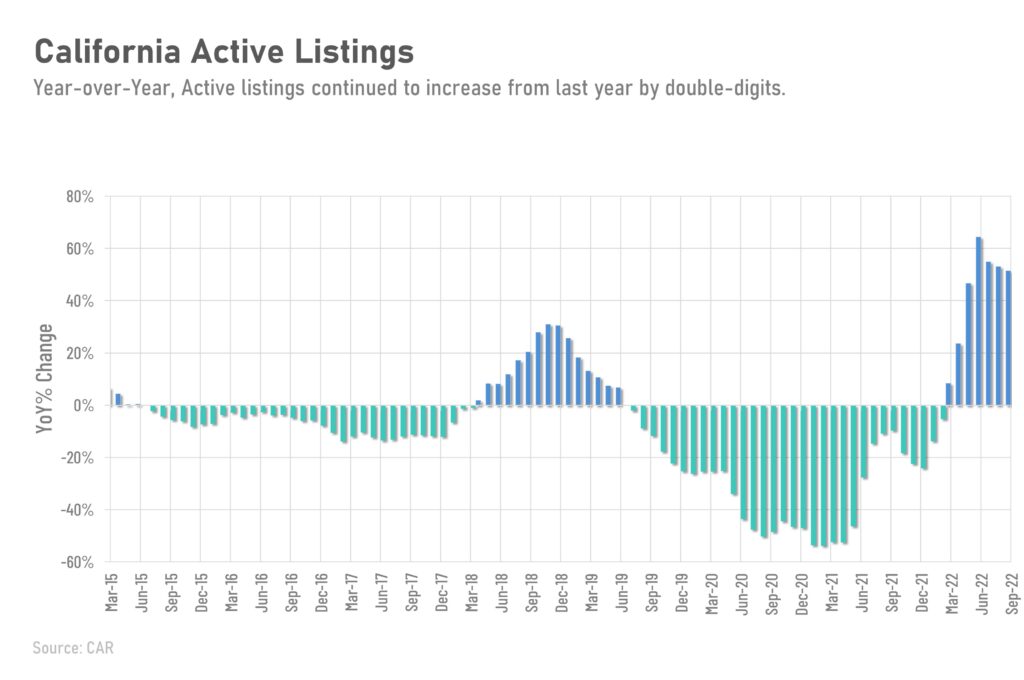

- Housing supply in the Bay Area improved from a year ago and was unchanged in September from the prior month despite a decline in housing demand.

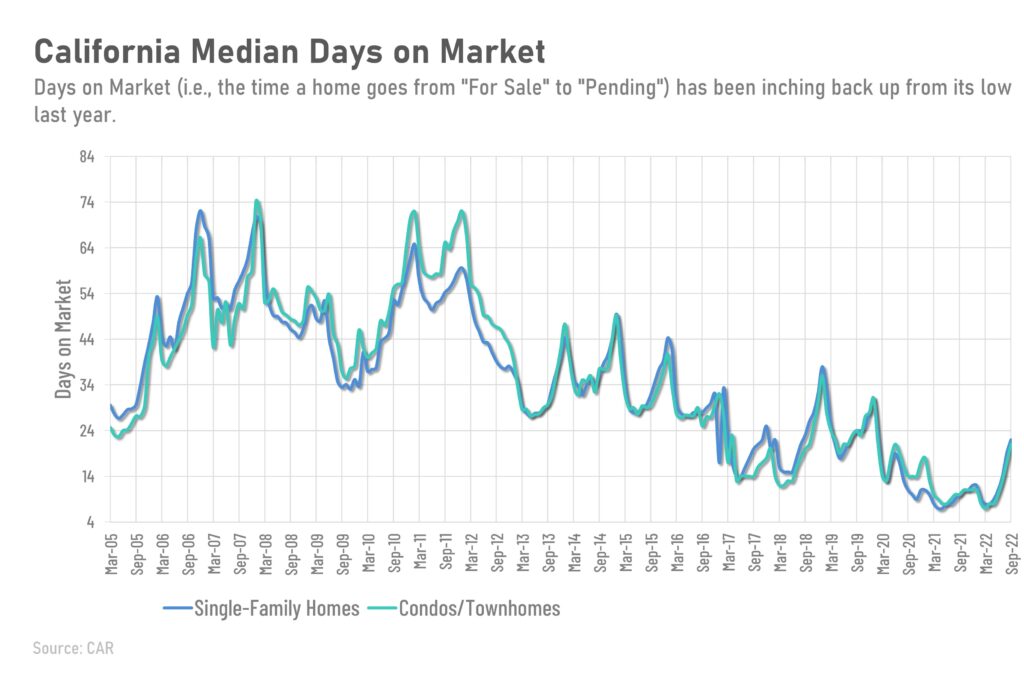

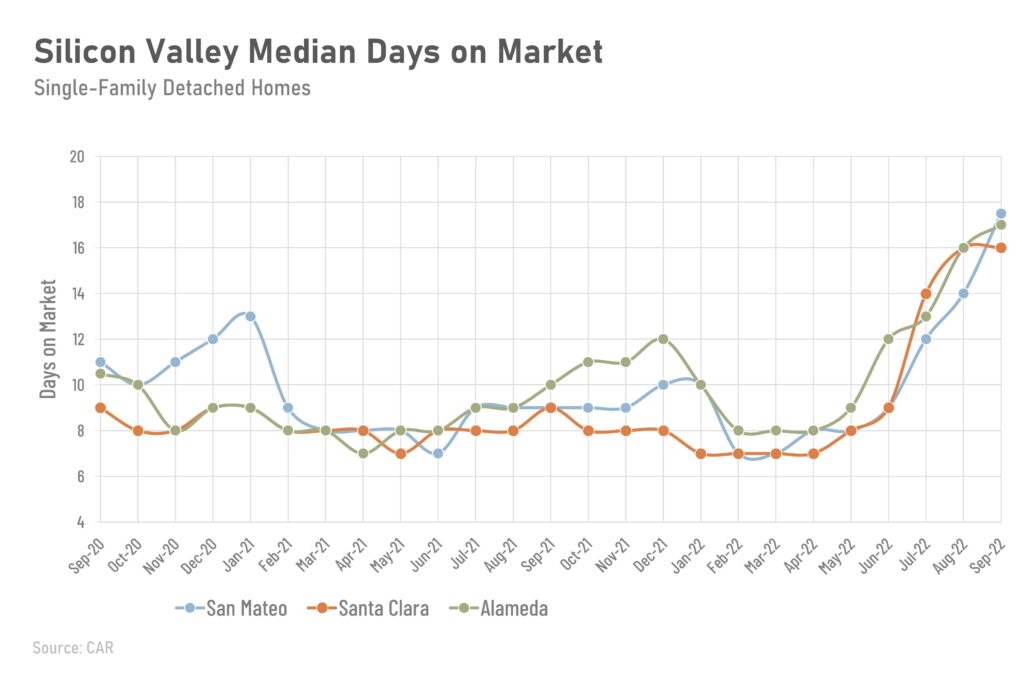

- The median number of days it took to sell a single-family home in the Bay Area continued to rise ending the quarter at 21 days compared to just 8 days in March and April of this year.

Housing market is cooling

The last couple of pandemic years have been unprecedented. The housing market was no exception. The hyper-low rates we saw during the pandemic allowed many more buyers to enter the market, leading to bidding wars and skyrocketing home prices. Nowhere was this more evident than in the Bay Area / Silicon Valley market. In the third quarter, the housing market has finally started to shift from the peak frenzy it saw over the past two years. Bay Area median single-family homes and condo prices not only declined from their peaks reached earlier this year, but the third quarter also saw a drop in year-over-year prices for the first time since May 2020. The decline is driven largely by rising mortgage rates.

Most recently, the average 30-year fixed mortgage rate from Freddie Mac ticked above 6% for the first time in well over a decade. That pushed on affordability and priced some buyers out of the market, resulting in significantly slower home sales and higher inventory of homes for sale.

As the housing market cools in response to the dramatic rise in mortgage rates, what can we expect for 2023? The truth is experts are divided on what’s ahead for 2023. The most likely outcome is slight price depreciation in some markets. In fact, the California Association of Realtor® recently released their 2023 California Housing Market Forecast, which predicts a retreat in home prices in 2023: "A less competitive housing market for homebuyers and a normalization in the mix of home sales will curb median price growth next year."

The good news is home prices are expected to return to more normal levels of appreciation rather quickly. The latest forecast from Wells Fargo shows that, while they feel prices will fall in 2023, they think prices will recover and net positive in 2024. That forecast calls for 3.1% appreciation in 2024, which is a number much more in line with the long-term average of 4% annual appreciation.

And the Home Price Expectation Survey (HPES) from Pulsenomics, a poll of over one hundred industry experts, also calls for ongoing appreciation of roughly 2.6 to 4% from 2024-2026. This goes to show, even if prices decline slightly next year, it’s not expected to be a lasting trend.

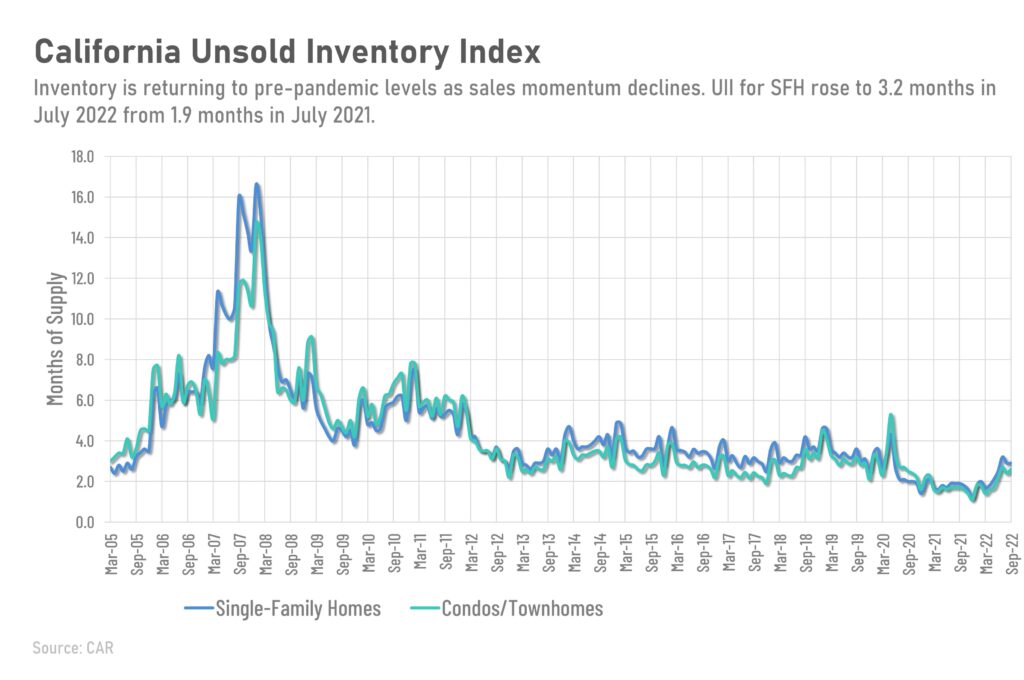

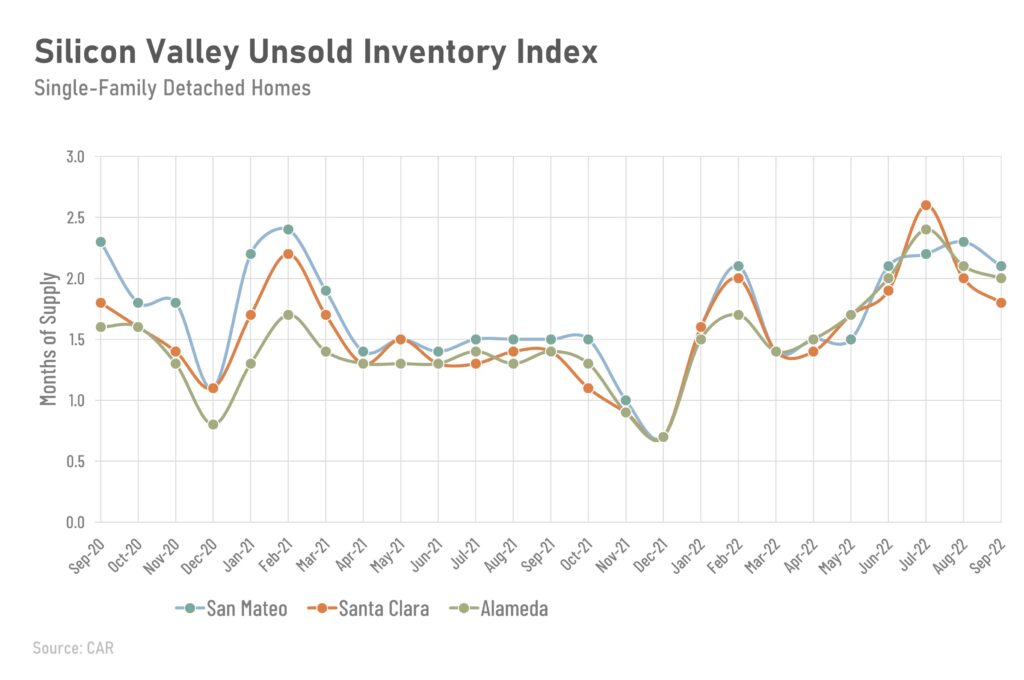

Unsold Inventory Index indicates continued sellers' market

The Unsold Inventory Index (UII) is a measure of the number of months it would take for all current homes on the market to sell at the current rate of sales. The long-term average UII is around three months in California, which indicates a balanced market. An UII lower than three months indicates that there are more buyers than sellers on the market, i.e., a sellers’ market, while a higher UII indicates there are more sellers than buyers, i.e. a buyers’ market.

The overall supply of homes in the Bay Area improved from April to July 2022, with the unsold inventory index (UII) rising from 1.5 months in July 2021 to 2.5 months in July 2022, the highest level since May 2020. This improvement was primarily due to a pullback in demand.

The UII fell again in August and September due to a brief drop in mortgage rates in August. New listings are expected to decline which will further reduce inventory as we head into winter.

Sales-to-list price ratio falls below 100% for first time

The sales-price-to-list-price ratio dropped below 100% for the first time since the pandemic in the third quarter of this year. Sales-to-list-price ratio is an indicator of the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio above 100 percent suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

Historical

Statistics are from the California Association of Realtors® Housing Market Overview report and reflect existing single-family homes except where indicated. % change is Year-Over-Year.