There are two crises in this country right now: a health crisis that has forced everyone into their homes and a financial crisis caused by our inability to move around as we normally would and the fact that many businesses have been put on hold.

Over 20 million people in the U.S. became instantly unemployed when it was determined that the only way to defeat this horrific virus was to shut down businesses across the nation. One minute they were gainfully employed, and in the next minute a switch was turned and the room went dark on their livelihoods.

The financial pain so many families are facing right now is deep. As the states are deciding on the best strategy to slowly and safely reopen, the big question is: how bad is it going to get and how long will it take the economy to fully recover?

How deep will the pain cut?

Major institutions are forecasting unemployment rates last seen during the Great Depression. Here are a few projections:

- Goldman Sachs – 15%

- Merrill Lynch – 10.6%

- Wells Fargo – 7.3%

How long will the pain last?

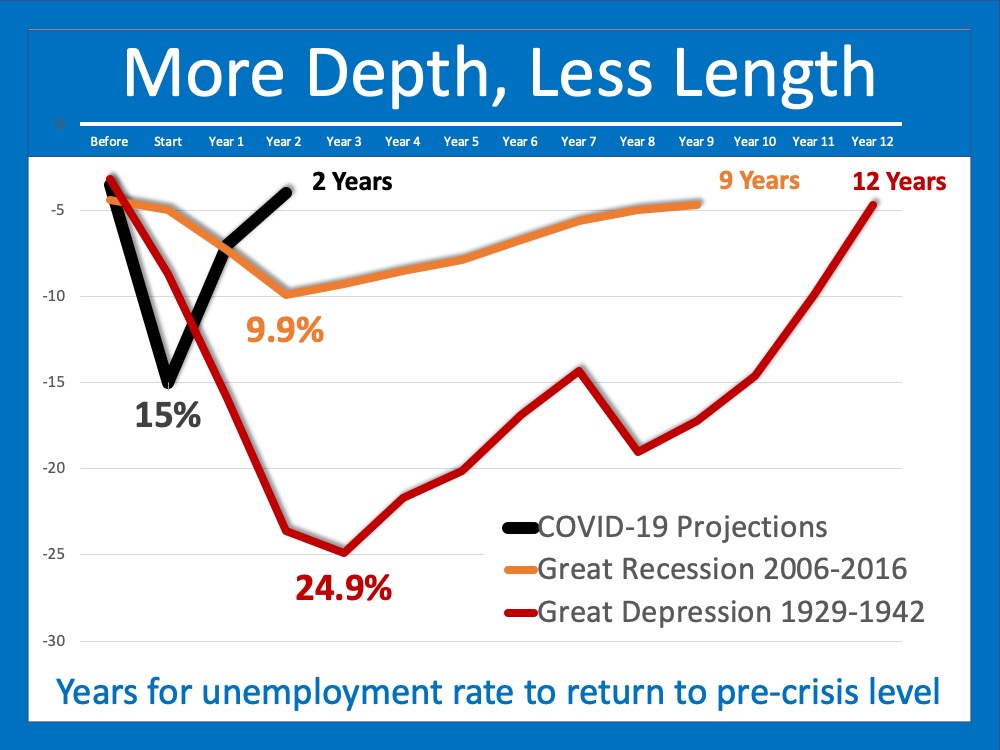

As horrific as those numbers are, there is some good news. The pain will be deep, but it won’t last as long as it did after previous crises. Taking the direst projection from Goldman Sachs, we can see that 15% unemployment quickly drops to 6-8% as we head into next year, continues to drop, and then returns to about 4% in 2023.

When we compare that to the length of time it took to get back to work during both the Great Recession (9 years long) and the Great Depression (12 years long), we can see how the current timetable is much more favorable.

What will the recovery look like?

Let’s look at the possibilities. Here are the three types of recoveries that follow most economic slowdowns (the definitions are from the financial glossary at Market Business News):

- V-shaped recovery: an economic period in which the economy experiences a sharp decline. However, it is also a brief period of decline. There is a clear bottom (called a trough by economists) which does not last long. Then there is a strong recovery.

- U-shaped recovery: when the decline is more gradual, i.e., less severe. The recovery that follows starts off moderately and then picks up speed. The recovery could last 12-24 months.

- L-shaped recovery: a steep economic decline followed by a long period with no growth. When an economy is in an L-shaped recovery, getting back to where it was before the decline will take years.

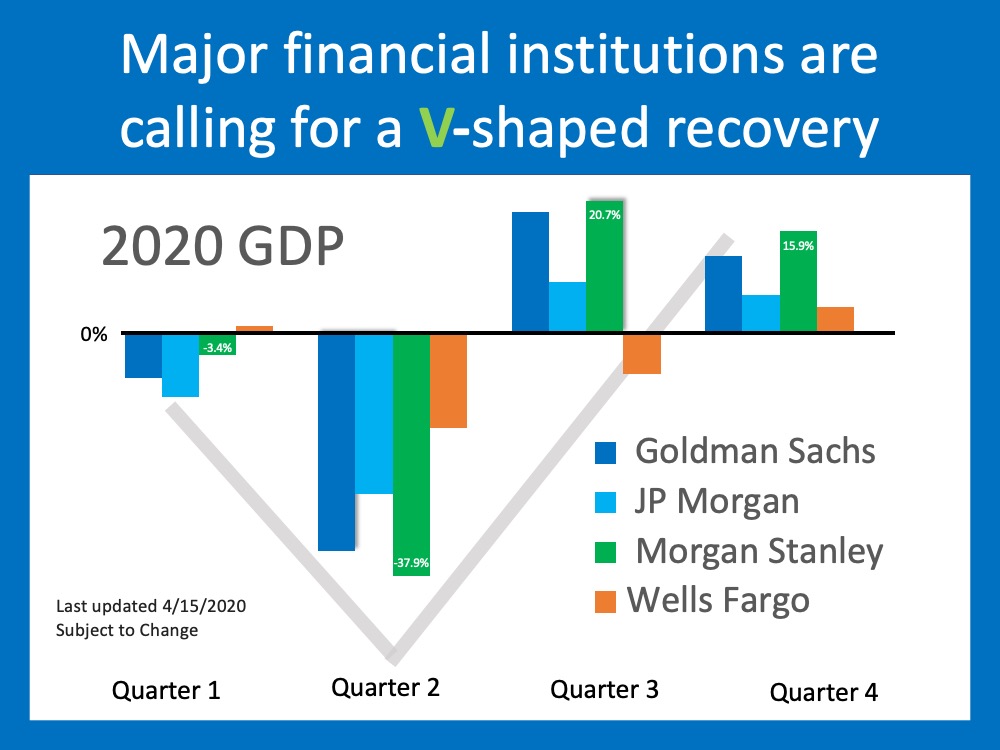

What type of recovery will we see this time? No one can answer this question with one hundred percent certainty. However, most top financial services firms are calling for a V-shaped recovery. Goldman Sachs, Morgan Stanley, Wells Fargo Securities, and JP Morgan have all recently come out with projections that call for GDP to take a deep dive in the first half of the year but have a strong comeback in the second half.

Is there any research on recovery following a pandemic?

There have been two extensive studies done that look at how an economy has recovered from a pandemic in the past. Here are the conclusions they reached:

1. John Burns Consulting:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

2. Harvard Business Review:

“It’s worth looking back at history to place the potential impact path of Covid-19 empirically. In fact, V-shapes monopolize the empirical landscape of prior shocks, including epidemics such as SARS, the 1968 H3N2 (“Hong Kong”) flu, 1958 H2N2 (“Asian”) flu, and 1918 Spanish flu.”

The research says we should experience a V-shaped recovery.

Uncertainty Abounds in the Search for Economic Recovery Timetable

Does everyone agree it will be a ‘V’? No. Some are concerned that, even when businesses are fully operational, the American public may be reluctant to jump right back in.

As Market Business News explains:

“In a typical V-shaped recovery, there is a huge shift in economic activity after the downturn and the trough. Growing consumer demand and spending drive the massive shift in economic activity.”

If consumer demand and spending do not come back as quickly as most expect it will, we may be heading for a U-shaped recovery.

In a message last Thursday, Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank, agrees with other analysts who are expecting a resurgence in the economy later this year:

“We’re forecasting real economic growth of 30% for the U.S. in the 4th quarter of this year and 6.1% in 2021.”

His projection, however, calls for a U-shaped recovery based on concerns that consumers may not rush back in:

“After the steep plunge and bottoming out, a ‘U-shaped’ recovery should begin as consumer confidence slowly returns.”

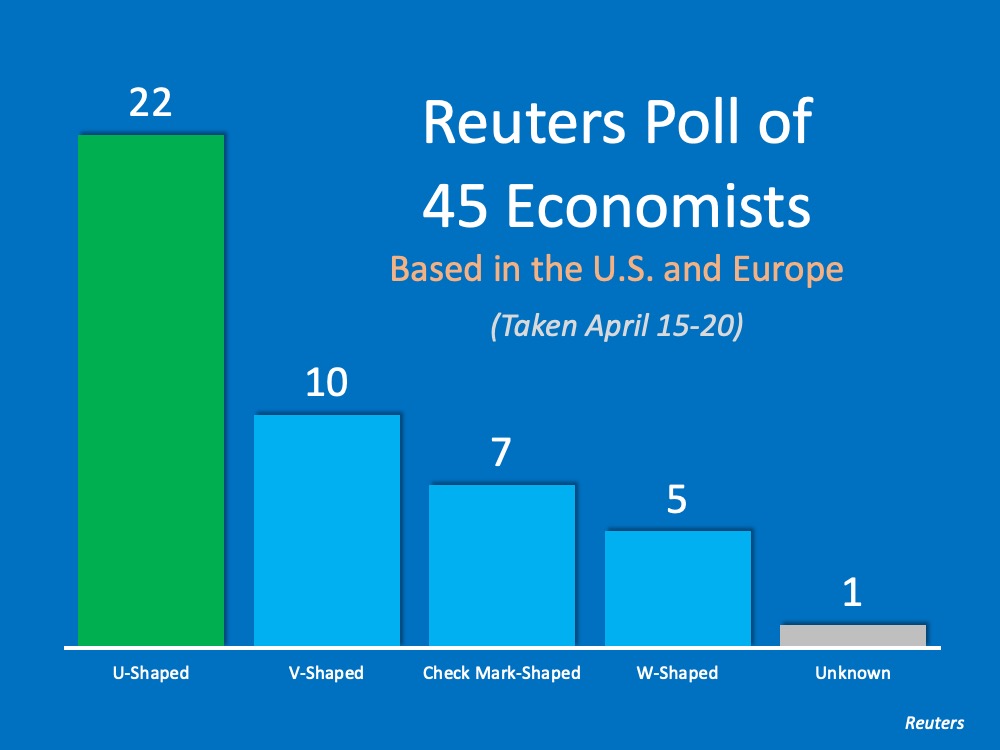

Others in the business community appear to be similarly shifting to that view, where the return to previous levels of economic success won’t occur until the middle of next year. According to a recent Reuters survey, a poll of U.S. and European economists which revealed that most surveyed are now leaning more toward a U-shaped recovery.

Here are the results of that poll:

Why the disparity in thinking among different groups of economic experts?

The current situation makes it extremely difficult to project the future of the economy. Analysts normally look at economic data and compare it to previous slowdowns to create their projections. This situation, however, is anything but normal.

Today, analysts must incorporate data from three different sciences into their recovery equation:

1. Business Science – How has the economy rebounded from similar slowdowns in the past?

2. Health Science – When will COVID-19 be under control? Will there be another flareup of the virus this fall?

3. Social Science – After businesses are fully operational, how long will it take American consumers to return to normal consumption patterns? (Ex: going to the movies, attending a sporting event, or flying).

The challenge of accurately combining the three sciences into a single projection has created uncertainty, and it has led to a wide range of opinions on the timing of the recovery.

Bottom Line

It’s devastating to think about how the financial heartache families are going through right now is adding to the uncertainty surrounding their health as well. Hopefully, we will soon have the virus contained and then we will, slowly and safely, return to work. However, no one knows for sure how quickly Americans will get back to “normal” life. Right now, the vast majority of economists and analysts believe a full recovery will take anywhere from 6-18 months. No one truly knows the exact timetable, but it will be coming.